If you’re in your senior year and preparing for graduation — congratulations! Graduating from college is a huge accomplishment.

But after the hat toss, you have to start worrying about things like finding a job. And, if you’re like most college students, you probably have student loan debt to manage, too. As you start preparing for graduation, here are five things you should do to handle your student loans.

1. Find Your Loan Details

You likely needed to take out several loans to pay for school. It’s common for graduates to have as many as 12 different student loans when they graduate from college. Worse, your loans can be sold and transferred to different servicers, making it difficult to keep track of your debt.

After you graduate, look up all of your student loans and figure out who your loan servicers are, what your monthly payment is, and your due dates.

Federal Student Loans

To find your federal loans, use the National Student Loan Data System. Just enter your Federal Student Aid ID and password and you can view all of the federal loans under your name. The site will list your loan servicer and loan balance. Once you have that information, you can go to the loan servicer’s website and create an account and start making payments.

Private Student Loans

For private loans, you can identify the different loans and lenders by looking up your credit report at AnnualCreditReport.com, which allows you to get one free credit report per year. Your credit report will show what company currently manages your loan. When you find your loan servicer, you can contact the company directly to find out how to open an online account and make payments.

2. Create a Budget

Your student loan payments will likely eat up a significant part of your monthly income, especially when you’re just starting out in your career. To make sure you can afford the payments and your other living expenses, spend some time creating a monthly budget.

While you can use software like You Need a Budget (YNAB), you can also make a budget with just a simple pen and paper. List all of your monthly income, including earnings from your job and side gigs. Next, list all of your expenses, such as rent, utilities, internet service, student loan payments, car payments, and insurance.

Hopefully, your income exceeds your spending. If that’s not the case, you’ll have to look for areas to cut to give you some more breathing room in your monthly budget. Or, you can boost your income by freelancing or launching a side gig.

3. Sign Up for an Income-Driven Repayment Plan

If your starting salary is too low, or if you can’t afford the payments on your federal student loans, consider signing up for an income-driven repayment (IDR) plan.

There are four different IDR plans. While the specifics of each plan vary, the general concept is the same: the loan servicer extends your repayment term and caps your monthly payments at a percentage of your discretionary income. Depending on your income and family size, you can dramatically reduce your monthly bill. In fact, some people qualify for payments as low as $0.

After 20 to 25 years of making payments, the loan servicer will forgive your remaining loan balance. While the forgiven amount is taxable as income, IDR plan forgiveness can still help you save thousands.

You can apply for an IDR plan online.

4. Refinance Student Loans

If you have private student loans or a mix of both federal and private loans and want to pay off your debt as quickly as possible, look into student loan refinancing. By working with a private lender to take out a loan for the amount of your existing debt, you could potentially lower your interest rate, helping you save money. Or, you could get a longer repayment term and reduce your monthly payments, making them more affordable.

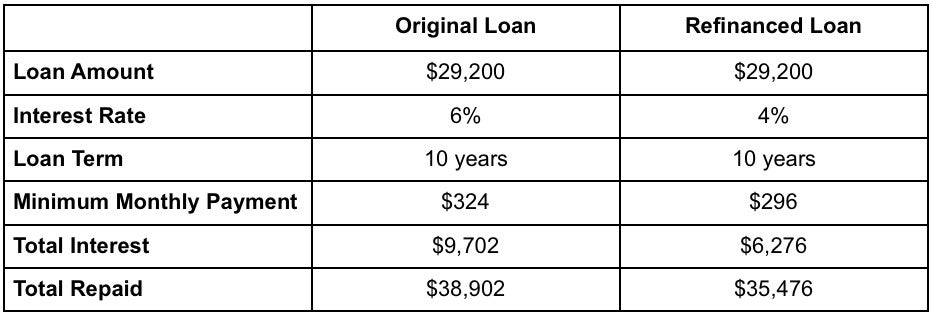

How effective is student loan refinancing? The savings can be significant. According to The Institute for College Access & Success, the average graduate has $29,200 in student loan debt. If you had that much debt with a 10-year repayment term and a 6% interest rate, your monthly payment would be $324. By the end of your loan term, you’d pay a total of $38,902.

But if you refinanced your debt and qualified for a 10-year loan at 4% interest, your monthly payment would drop to $296 per month. Over the course of your loan, you’d repay just $35,476. Refinancing your student loans would allow you to save over $3,400.

While there are some drawbacks to refinancing your education debt, refinancing can be a smart way to manage your loans. If you decide that student loan refinancing is right for you, use ELFI’s Student Loan Refinancing Calculator to get an idea of what your repayment plan could look like. Prequalification is 100% online, free, and won’t affect your credit score*.

5. Sign Up for Automatic Payments

Managing your different loans and their various payment due dates can be overwhelming. But missing a payment can hurt your credit, and you could be subject to costly fees and penalties.

Signing up for automatic payments is a great way to ensure you never miss a payment and improve your credit history.

The Bottom Line

Your college graduation may feel far off, but it’ll be here before you know it. When it comes to preparing for graduation, developing a student loan repayment strategy is essential. By creating a plan now, you can ensure you’re ready to handle your student loan debt when your payments are due.

*Subject to credit approval. Terms and conditions apply.

Notice About Third Party Websites: Education Loan Finance by SouthEast Bank is not responsible for and has no control over the subject matter, content, information, or graphics of the websites that have links here. The portal and news features are being provided by an outside source – the bank is not responsible for the content. Please contact us with any concerns or comments.