If you have a child getting ready for college, you may be anxiously awaiting acceptance letters from their selected schools. But when those letters come, they’ll also include financial aid award letters that detail what kinds of assistance your child is eligible for from the school. Most students get some help with their education costs. In fact, the National Center for Education Statistics reported that 72% of undergraduate students receive financial aid. However, those award letters can be confusing, so learning how to reach a financial aid award letter will help you understand each college’s actual cost.

What Is a Financial Award Letter?

Schools send financial aid award letters as part of their acceptance packets. It explains what aid the student is eligible for, the cost of attendance, and what the student’s expected out-of-pocket costs would be. Each school has its format and awards, so comparing college award offerings can be challenging.

What an Award Letter Includes

A typical award letter includes the following information about your child’s aid package:

- Gift aid: The letter will include any federal or institutional gift aid, including federal Pell Grants or school scholarships.

- Student Aid Index (SAI): Previously, the letters included the expected family contribution (EFC) — an index that schools use in their financial aid calculations to determine your aid package. The SAI has replaced the EFC for the 2024-2025 award year.

- Total cost of attendance: Beyond tuition, the cost of attendance includes other expenses, such as your room and board, textbooks, transportation, and dependent care costs.

- Loans and other options: The letter will also list the student loans and other financial aid options available, such as work-study programs.

Types of Financial Aid

Depending on the information submitted on the Free Application for Federal Student Aid (FAFSA), your child may be eligible for the following forms of aid:

- Scholarships: Scholarships are awarded based on achievements or merit, such as the student’s academic performance, musical talent, or athletic skills. These awards don’t have to be repaid.

- Grants: Grants are issued based on a student’s financial needs.

- Work-study: Not all schools participate in work-study programs, but if your child’s selected college does, your child can work part-time and use their earnings toward a portion of their education expenses.

- Federal loans: Federal student loans are the most common form of loan for college. The following loans are available to choose from:

-

- Direct Subsidized: These loans are only for undergraduate students with substantial financial needs. With Direct Subsidized Loans, the government will pay for the interest that accrues while the student is in school, during the grace period — the six months after the student graduates — and during any periods of deferment.

-

- Direct Unsubsidized: These loans are for undergraduate and graduate students. The borrower is responsible for all interest that accrues.

- PLUS Loans: PLUS Loans are for graduate students and parents of undergraduate students.

- Private loans: Private loans are available from credit unions, banks, and other financial institutions. There are loan options for undergraduates, graduate students, and parent borrowers.

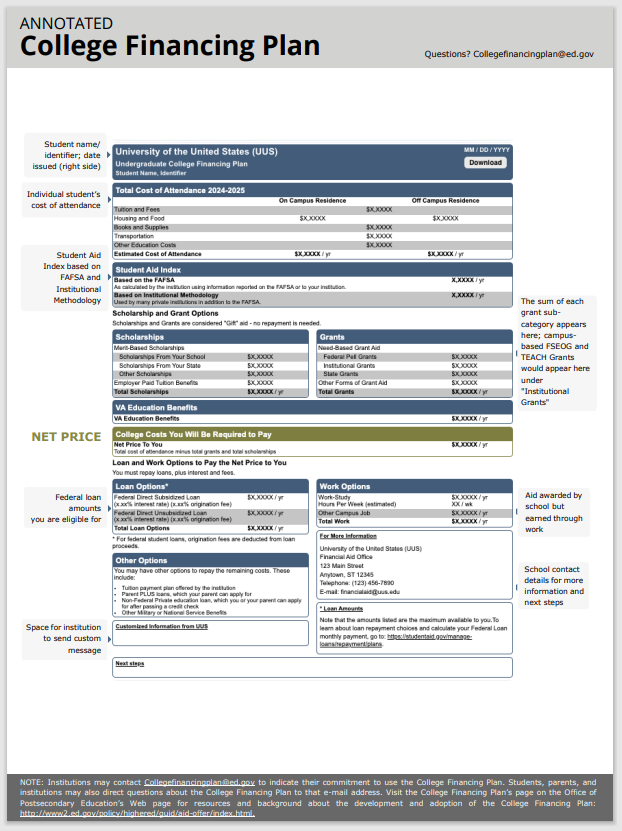

Sample Financial Award Letter

Below is an example of a college aid award letter. The format and appearance vary by school, but they all typically include the following:

-

- Details about the student: The letter will list the student’s information, including their identifier number.

- Cost of attendance: The letter includes the cost of attendance for the upcoming academic year, including all qualifying education expenses.

- SAI: The SAI is listed on the FAFSA. The number isn’t necessarily what your family is expected to pay for school; it’s a number that colleges use to calculate your financial aid package.

- Financial aid options: The available financial aid awards include grants, scholarships and loans.

- Net price: The net price is the cost of attendance minus your gift aid options, such as scholarships. The student has to pay the net price toward college and is a key factor to consider when deciding where to go to school.

Deciding Whether to Accept Federal Loan Offers

Your child will likely be offered federal student loans. Before accepting those loan options, consider these factors:

- Loan amount: Generally, the rule of thumb is to borrow no more than the student’s expected first-year salary after graduation.

- Rates: Student loan interest rates can significantly impact your overall repayment cost.

- Fees: Federal student loans have disbursement fees, which are deducted from the loan amount when they’re issued.

With federal loans, your child will be in repayment for at least 10 years, but with alternative repayment plans, they could be in debt for much longer.

How to Submit a Financial Aid Appeal

If the financial aid package is inadequate, you may be able to appeal the decision. Contact the college’s financial aid office and ask about the process for filing an appeal. If your finances have changed since the FAFSA was submitted — such as a job loss or the birth of a child — the student may be eligible for additional aid. To submit the appeal, you’ll need to supply documentation making your case, such as a termination letter from your employer.

Seeking Additional Aid? Next Steps to Consider

If your child doesn’t receive enough financial aid to cover the cost of their chosen school, consider these alternatives: Choose a less expensive school: Your child may be able to substantially reduce their costs by selecting another college. For example, public schools are less than half the cost of private schools, on average. Apply for external awards: Scholarships and grants aren’t only available from college or the federal government; your child can apply for external awards from non-profit organizations and private companies. Your child can search for scholarships on platforms like FastWeb. Apply for private student loans: Private student loans can play an important role in covering the gap between the financial aid package offered and what your child has to pay. With ELFI, you can view your loan options and apply online.