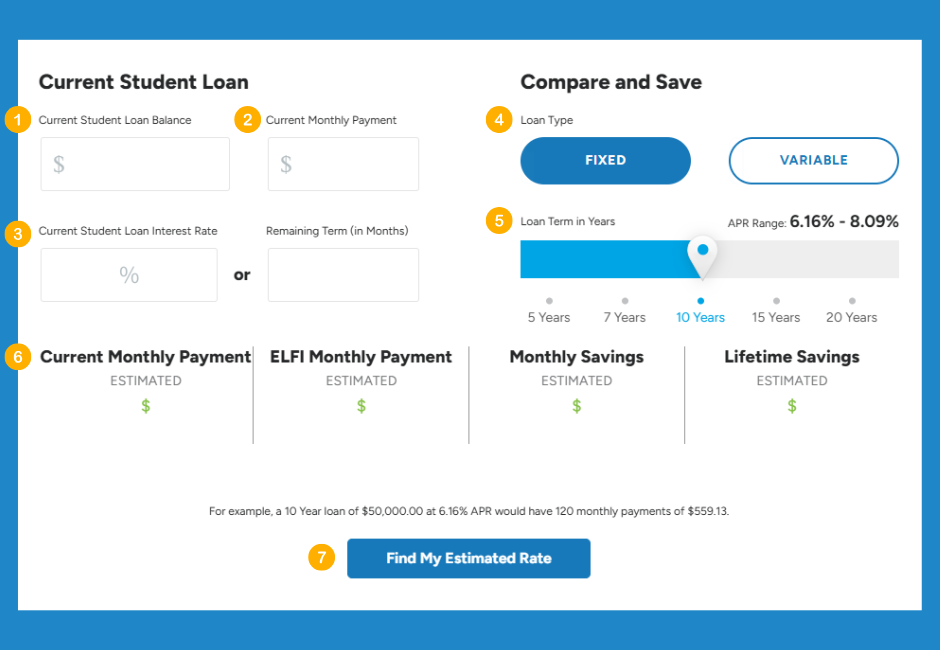

Wondering if it’s time to refinance your loans? Our student loan refinancing calculator can help you estimate how much you could save with ELFI. Here’s a breakdown of what you’ll need to enter in each field of the calculator.

1. Current Student Loan: Loan Balance

How much do you still owe on your loan? Entering the correct amount here is vital to getting a more accurate estimate of your savings.

2. Current Student Loan: Monthly Payment

This is how much you currently pay each month on your loan. If you have a variable monthly payment, enter the average here.

3. Current Student Loan: Interest Rate or Remaining Term (in months)

Here you have the option to enter, as a percentage, how much you currently pay in interest on your loan. OR you can enter, in months, how much time you have left until your loan is paid off. For example, if you have 7 years of payments left, you’ll enter 84 months.

4. Compare and Save: Loan Type

Here, enter the type of loan you’ll want after you refinance. This question isn’t asking whether you currently have a fixed or variable loan – it’s asking if you want your refinanced loan to have a fixed or variable rate. Choose the option that fits you.

5. Compare and Save: Loan Term in Years

Now tell us how long you want to spend paying off the loan – the answer could be anywhere from 5 to 20 years. Again, this is for your refinanced loan, not your current loan.

6. Current Monthly Payment | ELFI Monthly Payment | Monthly Savings | Lifetime Savings

You don’t have to enter any information into these fields. They automatically generate estimates based on the information you entered into the other fields on the calculator. Once you’ve entered your information into each field, you can look at these boxes to see a comparison of your monthly payment versus what you could save. You also have the option to go back and change any information you entered into the calculator when you’re done. Changing some of the options might reveal ways you could save even more.

7. Find My Estimated Rate.

Once you’re finished, click this button and ELFI will take you to our pre-qualification process if you’re interested in getting a quote or starting the refinancing process.

Ready to get started?

Try ELFI’s Student Loan Refinancing Calculator today!