As a child, it’s not uncommon to think that there are monsters hiding under your bed or maybe in your closet. You never actually think it through as to what really could be hiding but it’s something scary. Trust me, you didn’t want to ever have to come face-to-face with it. Thus, my reasoning for staying in bed every night and never moving. Oh, and of course hiding my arms under the blankets. You know you did it too! Well, at twenty-eight I think I’ve finally met those monsters. It was my credit! Throughout my life, I was terrified of credit. I, like many others, was taught credit cards lead to lifelong debt and it could ruin my life. Not only that but any minor change like closing a credit card account affected my credit score – SCARY! Credit, like most new things in life can be intimidating or maybe even scary, but we have to start somewhere. What most people, myself included, don’t understand about credit is that it can be a great thing when used responsibly. A good credit score can help with getting a house or buying a car. I now understand that credit is not a scary thing. Credit is only something you need to be responsible with. If you are a college student looking to build credit purchase only things that you can pay for. If you cannot guarantee that you can stay on top of payments, you shouldn’t be making purchases. While in college, if you decide to build credit it can help jump-start your life after college. Filling out applications with your credit score will be easy because you’ve already started building credit. In college, credit can be built through everyday expenses and can benefit you in the long run. Here are some simple ways of building credit that will not break the bank or “ruin your life,” but help you in the future.

Find a Credit Card

While in college, you may see a credit card offer dropped in your mailbox every week. Actually reading through the information and what the card offers is KEY. Look at interest rates and cash back rewards. Some cards have cash back rewards on points earned by using the card on things such as gas and groceries. By using a credit card for necessities and paying it off, you are earning easy credit while still in college. Some cards offer cash back opportunities on travel. If you’re going away to college, using a credit card could be a great way to earn points for a visit back home or a weekend getaway. Remember, use a credit card on things you will be able to pay back on time. This way you will be building credit while also gaining reward points to redeem on things you want to do. If you’re attending college you may want to check out student credit cards. Student credit cards can be a really great way to start building credit while you are in school. Be warned that you will still need to demonstrate a decent salary to qualify for a student credit card, simply being a student is not enough. Most student credit cards will not charge an annual fee and many offer additional perks.

Learn How Completing College Early Can Save You Money

Secure Credit Cards

If you don’t qualify for a student credit card or any traditional credit card because you don’t have a credit history look into secure credit cards. They work just like other credit cards but require a cash deposit, first. This deposit is usually in the hundreds or low thousands. If you make every payment in full and on time you’ll receive back your down payment. If you do not make payments on time or in full the lender keeps your down payment.

Rent

While being in college you will likely be moving into your FIRST apartment. An apartment can be a great way to start earning credit. Putting the rent in your name and paying it on time can assist in building credit. In order for rent to go towards your credit history, your landlord must be reporting the rent payments to one of the credit agencies. If your landlord isn’t reporting your rental payments it will not help you to build a credit history. In today’s society, it is also pretty uncommon for landlords to report rent payments to a credit agency. If your landlord isn’t reporting your rent payments to a credit agency it can’t hurt to ask if they could start! When sharing an apartment with roommates, it is vital for everyone living there to pay their share of rent on time. Finding roommates that share accountability is important when you are building a good credit score.

Get a Credit Builder Loan

A loan that is in place to IMPROVE CREDIT?! Sign me up! When you have a credit builder loan, you make payments into your savings account. After one year, you will get the amount you paid back and increase your credit score! A credit builder loan does not require good credit to begin, you just have to show proof of income. Start by applying for a credit builder loan, and begin to make payments on time. In order for you to be benefiting from a credit builder loan, you must be paying on time. The pros to a credit builder loan include getting the money you put in and having a better credit score at the end of the year!

Become an Authorized User

Becoming an authorized user is a smart and easy way to embark on creating credit while in college. Being an authorized user means that you can use another person’s credit card and your name will be included on the account. The process simply has the account user add your name to the credit card account. As an authorized user, you will not be responsible for paying back debts on the credit card. This responsibility will legally be in the original account holder’s name. The main goal for being an authorized user is to increase your credit score by having an account holder with an outstanding credit history. If you have an account holder who is known for paying their debt on time, this will increase your score, because you’re on the account. Keep in mind that you should ask someone who is trusted and reliable when becoming an authorized user.

Start on Student Loan Payments

As a former college student, I know that going to school full time while working enough to have money to start paying off student loans can seem impossible. Remember, you do not have to pay off large amounts right away. While in college, consider putting money aside to start paying off loans when you can. If you start loan payments early you will start to see positive growth on your credit score. The benefits of having student loans include helping build your credit score. If you decide to start paying off loans while in school, it will be before your loan deadline and will create less to pay off later. Even if you are not able to pay off large sums, these small amounts can make for fewer payments later on and a better credit score when you graduate from college.

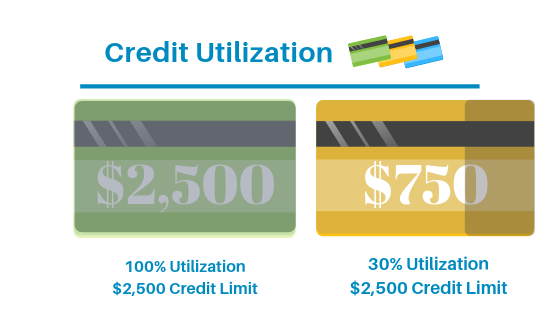

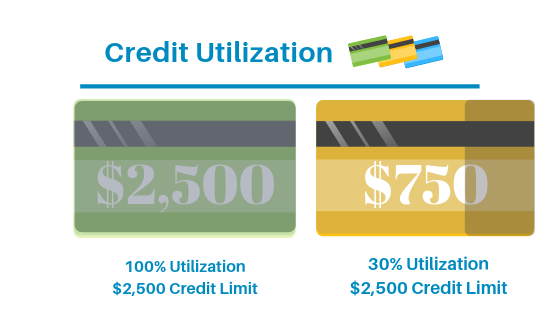

Credit Utilization

A top way to build credit is not to utilize all the credit that is available to you. For example, if you have a credit card with a credit limit of $2,500 and the balance is $2,500 that would be 100% credit utilization. Credit utilization is important because it impacts your credit score. The maximum recommended credit utilization is about 30%. Therefore, if your credit card had a maximum limit of $2,500 then 30% of that would be $750. In this example, to avoid negatively impacting your credit score you should not spend over $750 on your credit card.

BONUS: Credit Reports

While we are on the topic of creating good financial habits, the number one habit you can create is looking at your credit report. If you talk with any financial expert, this will be their number one piece of advice! Yearly, check your credit score and your credit report. Think about it like an annual physical at the doctor, but for your finances. Review your credit report to make sure that there are no errors or fraud to your credit history. If you visit AnnualCreditReport.com you can receive a free credit report from all three major credit agencies in the U.S. and a free credit report can be requested every 12 months. Having paid off debt or using credit in college will prepare you for future payments on cars, houses, and throughout your adult life. Knowing your responsibilities and taking care of payments on time is key to achieving a better credit score by the end of your college career. Consider these options when deciding how to build credit and choose one that will benefit you in the long run.

Are Student Loans Impacting Your Credit Score?

NOTICE: Third Party Web Sites Education Loan Finance by SouthEast Bank is not responsible for and has no control over the subject matter, content, information, or graphics of the websites that have links here. The portal and news features are being provided by an outside source – The bank is not responsible for the content. Please contact us with any concerns or comments.