The CARES Act and Employer Student Loan Contributions

Update 12/27: The CARES Act provision allowing employers to contribute up to $5,250 tax-free annually to their employees' student loans has been extended from the previous deadline of December 31, 2020 to December 31, 2025.

The tax breaks within the CARES Act are changing the way that both employers and employees are viewing student loan repayment assistance as a potential company benefit. Read these frequently asked questions to learn more about this provision, and scroll on to calculate the potential impact of repayment assistance and download our email template to encourage your company to sign up.

Frequently Asked Questions

SEC. 2206. EXCLUSION FOR CERTAIN EMPLOYER PAYMENTS OF STUDENT LOANS.

(a) IN GENERAL.—Paragraph (1) of section 127(c) of the Internal Revenue Code of 1986 is amended by striking ‘‘and’’ at the end of subparagraph (A), by redesignating subparagraph (B) as subparagraph (C), and by inserting after subparagraph (A) the following new subparagraph: 5 ‘‘(B) in the case of payments made before December 21, 2025, the payment by an employer, whether paid to the employee or to a lender, of principal or interest on any qualified education loan (as defined in section 221(d)(1)) incurred by the employee for education of the employee, and’’.

(b) CONFORMING AMENDMENT; DENIAL OF DOUBLE BENEFIT.—The first sentence of paragraph (1) of section 221(e) of the Internal Revenue Code of 1986 is amended by inserting before the period the following: ‘‘, or for which an exclusion is allowable under section 127 to the taxpayer by reason of the payment by the taxpayer’s employer of any indebtedness on a qualified education loan of the taxpayer’’.

(c) EFFECTIVE DATE.—The amendments made by this section shall apply to payments made after the date of the enactment of this Act.

Employers and employees alike greatly benefit from the passage of this act. Employers are now able to make payments toward their employees’ student loans on a tax free basis (up to $5,250 annually), thereby enabling employers to recruit and retain top-tier talent by helping employees repay their student loans.

Employees are able to receive contributions toward their student loans from their employer without paying any taxes on the contributions (up to $5,250 annually), thereby enabling employees to save money on interest and pay off their loans more quickly while receiving this unique benefit.

Additionally, employers may also choose to provide payments to former employees, such as those that have retired, left work and are on disability, or have been laid off.

Any loan deemed a “qualified education loan” by the IRS standards is eligible for the tax exemption. Under this standard, most private student loans and federal student loans are eligible.

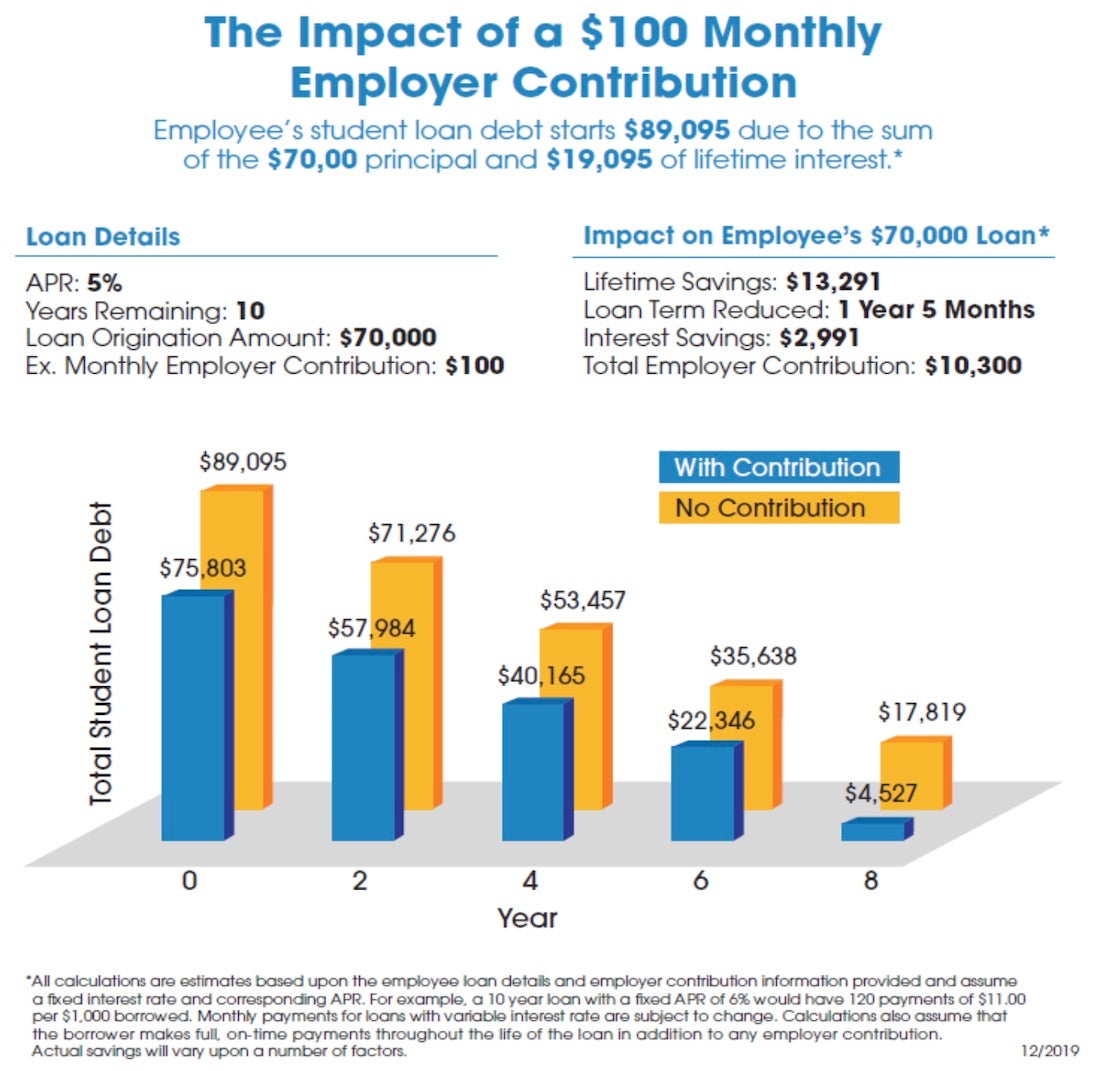

The chart below is a hypothetical illustration of potential savings for an employee with $70,000 in student loan debt when receiving $100/month from their employer. In this scenario, the employer contributions result in total savings of over $13,000 for the employee!

Offering student loan debt assistance as an employer can have a significant positive impact on your business. Employers who offer student loan debt assistance are better able to recruit top tier talent and boost employee loyalty and retention by helping employees get out of debt faster. In fact, 86% of employees would commit to a company for 5 years if they helped pay off their student loan debt. Furthermore, 4% of companies nationwide are already offering this benefit to their workforces highlighting the existing demand for student loan debt assistance.

Education Loan Finance offers an enterprise platform called ELFI for Business which enables our corporate clients to help their employees pay down their student loan debt faster. Through our simple and seamless integration, we provide you with a link to place on the benefits section of your Human Resources webpage that will bring your employees directly to the ELFI online application.

We offer multiple ways for employers to contribute to their employees’ student loan debt:

- Employers can make upfront contributions through their payroll

- Employers can make a bonus payment that can be applied directly to employee student loan debt

- Employers can also make automatic monthly contributions that will be sent directly to the loan servicer on behalf of the employee

Update, 8/24/2022: On August 24, 2022, President Biden announced his plan to forgive up to $10,000 in federal student loan debt and up to $20,000 for Pell Grant recipients. The debt forgiveness will be limited to borrowers with incomes of less than $125,000 a year or families earning less than $250,000. In addition, the Biden administration has extended the payment pause on federal student loans until December 31, 2022, with payments to resume in January 2023.

Section 127 Educational Assistance Program Requirements

In order to benefit from the expansions to section 127 under the CARES Act, companies that do not have a program must first adopt a Section 127 Educational Assistance Program. If there is already a program in place, employers will be permitted to make amendments to their plan to allow for:

- Direct payments to the lender

- Payments to the employee

- To pay/reimburse principal and interest payments on a “qualified education loan” incurred by the employee for education

Additionally, companies must comply with the following provisions to benefit from expansions to section 127 in the CARES ACT:

- The employer must notify employees of changes to the program.

- The program must be in writing.

- Employees cannot have the choice between getting cash or other taxable wages/benefit and the student loan repayment benefit

- The program can’t be offered as part of a cafeteria plan.

- The program cannot discriminate in favor of highly compensated employees.

- No more than 5% of payments may go to shareholders & owners who have more than 5% of the company’s stocks or capital

- The program may require anyone who receives benefits under the program but does not satisfy some subsequent condition to repay the benefits under a claw-back provision.

Student Loan Employer Contribution Impact

Calculate the estimated savings of monthly employer student loan contributions.

†All calculations are estimates based upon the employee loan details and employer contribution information provided and assume a fixed interest rate and corresponding APR. Monthly payments for loans with a variable interest rate are subject to change. Calculations also assume that the borrower makes full, on-time payments throughout the life of the loan. In addition, to any employer contribution. Actual savings will vary based upon a number of factors.

If your student loans aren’t eligible for relief as outlined in the CARES Act, such as some Perkins and Federal Family Education Loan (FFEL) loans, consider refinancing your student loan debt to take advantage of low interest rates. You can apply for student loan refinancing with ELFI 24/7 using our fast, 100% online loan application system.