How to Manage Student Loans During the New Forbearance Extension

February 1, 2021Last Updated on August 26, 2022

On August 24, 2022, President Biden announced his plan to forgive up to $10,000 in federal student loan debt and up to $20,000 for Pell Grant recipients. The debt forgiveness will be limited to borrowers with incomes of less than $125,000 a year or families earning less than $250,000. In addition, the Biden administration has extended the payment pause on federal student loans until December 31, 2022, with payments to resume in January 2023.

This announcement comes as part of a three-part plan from the Biden administration to provide targeted student debt relief, make federal student loans more manageable for borrowers, and reduce the cost of college.

Since March 2020, required federal student loan payments have been suspended as part of Coronavirus aid, Relief, and Economic Security Act (CARES Act) administrative forbearance. On January 21, president Biden signed an executive order extending the forbearance period until September 30, 2021.

This is a relief for many of the more than 42 million federal student loan borrowers, several of whom have struggled to make loan payments during the economic downturn caused by COVID-19. Today’s blog will discuss how federal borrowers can best manage their student loans during the forbearance extension.

Timeline of Federal Student Loan Administrative Forbearance & Extension

To better understand our current economic environment, let’s take a look at the events leading up to January’s student loan forbearance extension:

March 20, 2020: The Secretary of Education directed the Office of Federal Student Aid to provide student loan relief. This relief included suspended loan payments, paused collections on defaulted loans and 0% interest for a 60-day period.

March 27, 2020: The CARES Act was passed, extending relief measures for federal student loans through September 30, 2020. It also enabled employers to make nontaxable student loan assistance payments of up to $5,250 to employees through the end of the year.

August 8, 2020: President Trump signed an executive order extending federal student loan administrative forbearance through December 31, 2020.

December 4, 2020: The Secretary of Education extended the student loan forbearance period until January 31, 2020.

December 27, 2020: President Trump signed the Consolidated Appropriations Act (CAA) into law. This act lengthened the time period that employers may make tax-free contributions toward eligible employee education expenses. Employers can continue to contribute up to $5,250 annually until 12/31/2025.

The CAA also included the FAFSA Simplification Act, which was designed to help streamline the often-complicated financial aid form. One major change included shifting the term “Expected Family Contribution” to “Student Aid Index,” and changing the financial aid structure to offer more equal educational opportunities to low-income families. The changes are expected to take effect in 2023.

January 20, 2021: President Biden extended the administrative forbearance period on federal student loans through September 30, 2021.

Choose the Repayment Strategy That Best Fits Your Goals

Depending on your financial situation, you’ll likely have different goals than some others when it comes to paying down student loans. Here are a few examples:

Pay the Least Possible Interest

Some student borrowers aim to pay the least possible interest over their repayment periods. If this is your goal, consider accomplishing it using a debt repayment strategy like the Debt Avalanche method.

With this strategy, borrowers pay down their highest-interest loans as quickly as possible by making large or extra payments as often as possible. Once the highest-interest loan is paid off, use the money you’re no longer paying toward that loan to eliminate the loan with the next-highest interest.

During administrative forbearance, federal student loans are not accruing interest. If you can continue to pay down your balance during this period, you’ll owe less total interest on your loans when standard payments resume.

Pay Off Your Loans Quickly

If you’re looking to pay down your loans as quickly as possible, it’s important to stay motivated. Choose a strategy that keeps you focused on success so you can continue to make progress.

The Debt Snowball method is often a good fit for borrowers looking to pay down their loans quickly while keeping morale high. This method is focused on small wins, so you’ll start by paying off your smallest loan first. When it’s gone, roll those extra funds into paying off your next-smallest loan, until all of your student loans are paid off.

During federal student loan administrative forbearance, if you have the financial flexibility, you can continue to make student loan payments. Every payment you make during this time will count toward principal, so you can focus on decreasing your remaining loan balance quickly.

Save on Monthly Student Loan Payments

If you’re concerned about making your loan payments, then you may choose to consider an Income-Driven Repayment plan after administrative forbearance ends.

- Income-Driven Repayment (IDR) is designed for individuals whose income cannot reasonably cover the amount they’re required to pay in student loans each month. You can choose from several different plans to make your payment more manageable, including:

- Revised Pay As You Earn Repayment Plan (REPAYE)

- Income-Based Repayment Plan (IBR)

- Income-Contingent Repayment Plan (ICR)

- Income-Sensitive Repayment Plan

With IDR plans, your monthly payment will be based on various factors like your income and family size. While these plans often require you to pay more in interest over the life of your loan, they can also afford you the financial flexibility that you need.

Student loan refinancing is another fantastic way to save on monthly student loan payments and save on interest costs. We will explore this option further in the next section.

Student Loan Refinancing

Student loan refinancing is a fantastic way to accomplish several of these financial goals at once.

When you refinance your student loans, you agree to transition your remaining loan balance to a new lender in exchange for updated terms. The new lender will then pay off your old lender, and you’ll make payments to the new lender under the agreed-upon terms.

The new lender may offer you a lower interest rate, meaning you’d save money during repayment. When you refinance, you also often have the chance to change your student loan repayment term. You can lengthen your term for a lower monthly payment, or shorten it for faster repayment and typically a lower interest rate.

Can I Refinance Only Private Student Loans?

One of the many benefits of student loan refinancing is that you can often select the loans you want to refinance. For example, if you’d like to keep your federal loans in administrative forbearance, you can choose to refinance only your private student loans. You can begin working toward your financial goals without losing federal benefits.

If you have federal student loans but believe you could improve your interest rate by refinancing, then you could also consider refinancing part of your balance. For example, if you have a single federal student loan, you may choose to refinance part of the balance to a lower interest rate, while leaving the rest in administrative forbearance.

It’s important to remember that if you do refinance any portion of your federal student loans, however, they will no longer be eligible for the current federal protections.

Should I Refinance My Federal Student Loans?

One of the biggest questions that borrowers may ask during the administrative forbearance is whether or not they should refinance federal student loans. Rates for student loan refinancing are currently at historical lows, making it an intriguing option.

Choosing to refinance your student loans is a personal decision to be made based on your current finances and goals. It’s important to note, however, that if you can procure a low enough interest rate, you may decide to refinance to take advantage of the long-term interest savings.

Depending on your loan balance and terms, you may be able to save the same amount or more in interest costs by taking advantage of a lower interest rate now, rather than paying down principal and refinancing at a higher interest rate later.

As an example, let’s assume you currently have $70,000 in student loan debt with a 10-year term, and an interest rate of 6.08% (the 2019 Grad Plus Loan rate), and consider two options:

Scenario 1: You opt not to refinance and continue to make your regular monthly payments until your loans are paid off. You also decide to forego making payments on your student loans during the administrative forbearance. In this scenario, you would end up paying approximately $93,595 over the life of your loan.

Scenario 2: You refinance now (February 1) to a 3% rate and a 10-year term. In this scenario, you would have a total loan payment of $81,111. Refinancing now would end up saving you approximately $12,484 over the life of your loan vs. opting not to refinance at all.

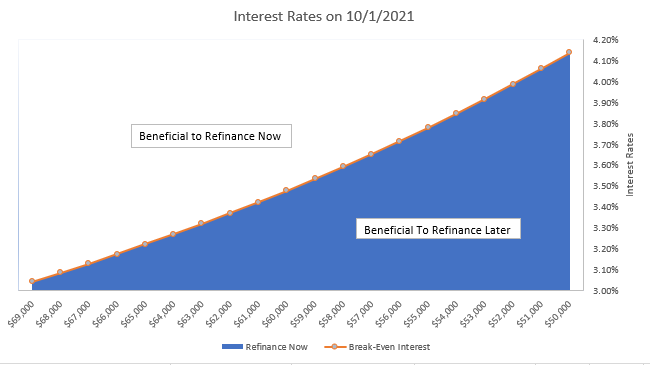

Scenario 3: Due to being charged 0% interest from now until October 1, you opt to continue making payments on your student loan debt for the next 8 months and will refinance following the administrative forbearance. For example, on February 1, you had a $70,000 loan balance with a 6.08% interest and could refinance at 3% (Scenario 2), but instead chose not to refinance and paid off $1,000 over the next 8 months. You would end up with $69,000 left of principal to refinance on October 1. On October 1, interest rates have risen to 3.042% and you decide to refinance at this rate. You would make total loan payments of $81,111, which is comprised of $1,000 of previously paid principal, $11,111 of total interest, and $69,000 in remaining principal. As you can see, total loan payments for Scenarios 2 and 3 are the same at this break-even interest rate of 3.042%. The graph below shows break-even interest rates for different remaining balances after 8 months with the same $70,000 loan.

When making this decision, you ultimately have to rely on your prediction as to whether interest rates will rise, and by how much, during the additional 8-month forbearance period while also predicting how much you plan to put toward your student loan balance during that time period. If you believe rates will stay low and you plan to make additional payments during the forbearance period, you may want to refinance later. If you believe rates will rise, refinancing now may be more advantageous. If you’re interested in seeing how much you could save by refinancing, check out our student loan refinancing calculator.

Bottom Line

To make the best possible decision regarding your student loans, be sure to pay attention to student loan legislation and interest rate movement. You can also explore options like Income-Driven Repayment (IDR) plans or student loan refinancing if you’re concerned that your student loan payments may become overwhelming.