Women and Student Loan Debt

October 12, 2018Last Updated on May 25, 2023

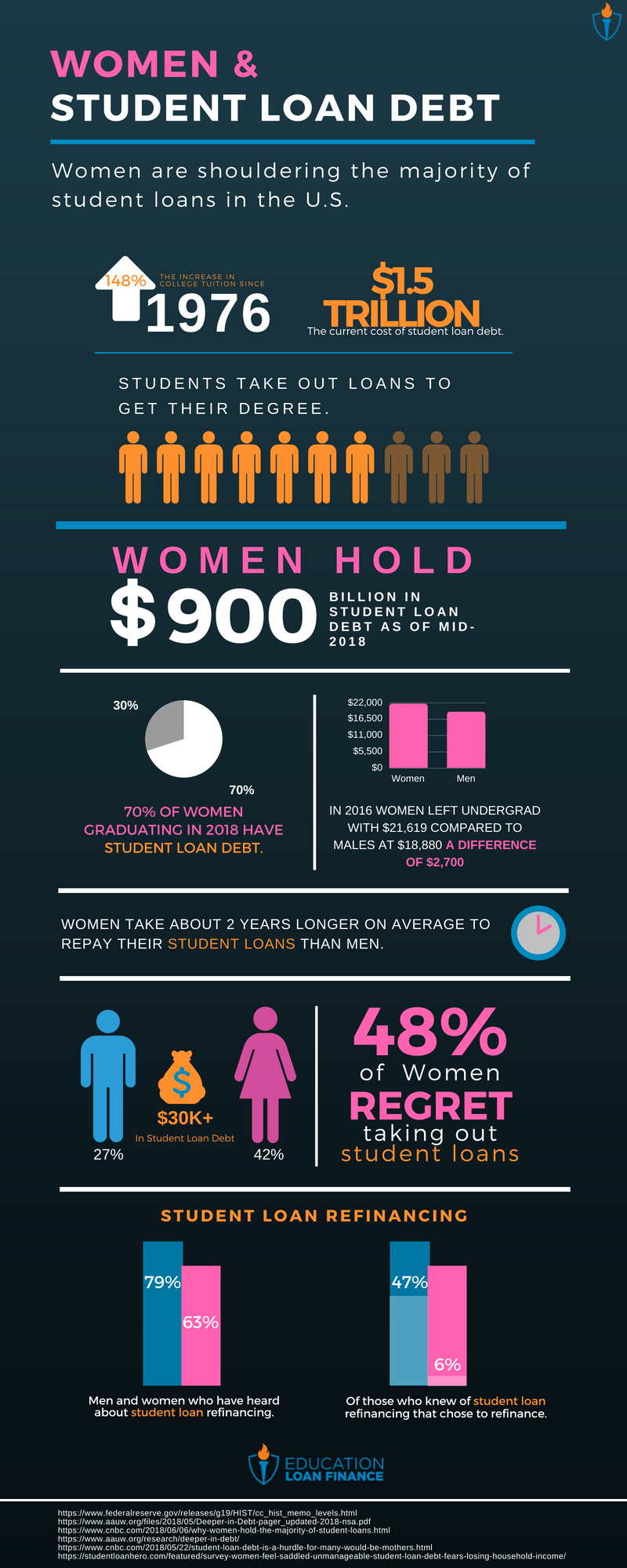

The cost of college has been on a slow increase since about 1976, and it’s no wonder the cost of student loan debt has too, seen a hike. According to AAUW the cost of college has increased 148% since then. Student loan debt has been estimated to total around $1.5 Trillion according to the Federal Reserve. Women prove to hold more than half of student loan debt. Let’s take a look at some factors that could be causing women to keep more student loan debt than men.

Women Less Likely to Refinance Student Loans

Refinancing student loans can help to achieve a lower interest rate and consolidate multiple loans. Refinancing also allows borrowers to change the repayment period, so they are paying less over the life of the loan. According to Student Loan Hero research, of the women who have heard about student loan refinancing, only 6% have proceeded to refinance their student loans. By not refinancing, women are subject to long payment periods that could end up costing them more over time.

Lack of Opportunity

Women are shown to have less executive or leadership roles in companies when compared to men. Research by Pew Research Center shows that woman hold only 10% of top executive positions. That leaves 90% of the remaining leadership positions for men. With mostly men in high ranking positions, it seems reasonable to assume that men, in general, would be making larger salaries than women due to a higher percentage of men in executive positions.

Student Loan Refinance Head Barbara Thomas’ Advice to Those Caught in the Gender Gap

Missed Work Hours

A possible reason for women holding more student loan debt is that they may be getting paid less because of their time off. Women have traditionally held the majority of the parenting responsibility. If a child was sick or ill it was usually the female who would stay home with the child or that is what traditional gender roles would assume. Pew Research has shown that parenting can hurt your earnings. Time away from the office dealing with children could be not only a reason for less pay but a lack of ability to pay student loan debt down faster.

Women Get Paid Less

The pay gap between men and women varies based on location, but women still make less than men. Can you believe it in 2018 women are still fighting for their right to be equal? According to information provided by the US Census Bureau, women earn 19.5% less than their male counterparts. In some states like Louisiana, the gender pay gap is a whopping 30%. In states like New York, it is only 11%.

Lack of Financial Literacy

According to CNBC women are shown to be less financially literate than men. If women make poor choices with their money, it could end up costing them in the long run, causing women to have more substantial student loan debt than men. Women are two times more likely to see their student loan debt as “unmanageable” according to Student Loan Hero.

Refinancing student loans is a great option for those with student loan debt. If you qualify for refinancing you can change repayment dates and possibly get a lower interest rate. An added benefit for those with multiple loans is that if you choose to refinance all your loans you’ll only have to make one payment a month instead of multiple payments. Refinancing your student loans can help to eliminate student loan debt faster depending on the repayment terms you select. Let’s start lowering the number of men and women with student loan debt!